CeMAP Online

Study Option: Self Study

CeMAP Qualification Training Courses.

Welcome to the world of CeMAP e-learning, the premier online course designed to equip you with the knowledge and skills needed to excel in the mortgage advice industry. CeMAP, the Certificate in Mortgage Advice & Practice, is a widely recognised qualification that opens doors to a rewarding career as a mortgage advisor. With our comprehensive CeMAP online course, you’ll have the flexibility to learn at your own pace, accessing high-quality study materials, interactive Q&As and expert led revision tutorials that help consolidate your learning.

Whether you’re a beginner looking to enter the industry or an experienced professional seeking to enhance your expertise, our CeMAP e-learning course offers a dynamic and engaging learning experience that empowers you to succeed in the fast-paced and ever-evolving mortgage sector.

Course Fee:

CeMAP 1: £345+vat

CeMAP 2&3: £345+vat

Tip: enrol on both events at the same time to receive 10% off.

Duration:

120 study hours

(approx. 60 hours per course)

LIBF Registration Fees:

£223 (per module)

*Price includes exam, membership & learning material.

Tip: ask your course adviser to process on your behalf.

Entry Requirements:

There are no entry requirements for this qualification.

Awarding Body

Flexible Study

Quality Assured Tuition

100s of Exam Q&As

Important Notice:

As CeMAP gains increasing popularity, numerous dishonest training providers have entered the marketplace and are currently advertising inferior courses on platforms such as Google and Groupon. These courses might lack up-to-date information or contain incomplete content, and the companies offering them may not possess the necessary skills or industry experience to provide CeMAP training courses. To learn more about the factors you should consider while selecting a CeMAP training provider, please refer to our explanatory video available here.

Course Structure

The online CeMAP course is designed to provide a comprehensive and flexible learning experience for individuals seeking to become mortgage advisors.

The course structure consists of three modules, each focusing on different aspects of mortgage advice and practice. Module 1 covers UK Financial Regulation and Ethics, providing a solid foundation. Module 2 delves into Mortgage Law, Policies, and Practices. Finally, Module 3 focuses on Mortgage Applications and the Sales Process, equipping learners with the skills needed to effectively advise clients and navigate the mortgage application journey.

The e-learning format offers quality assured training materials and as part of the package you have the option to enrol on expert-led revision tutorials at no additional charge in order to help consolidate your learning prior to sitting your exams.

Learners have the flexibility to study at their own pace and access the course materials online anywhere, making it a convenient option for those with busy schedules.

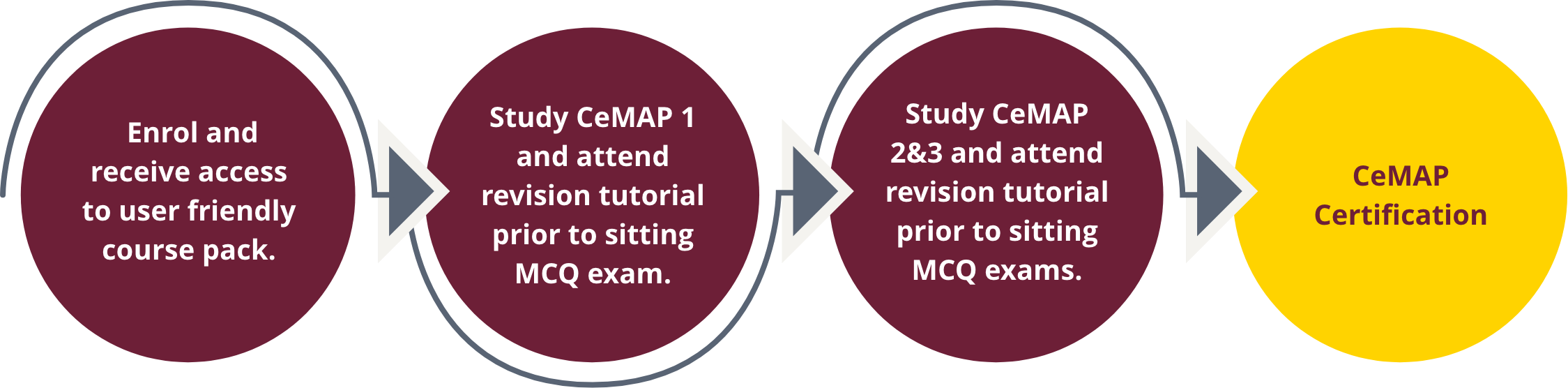

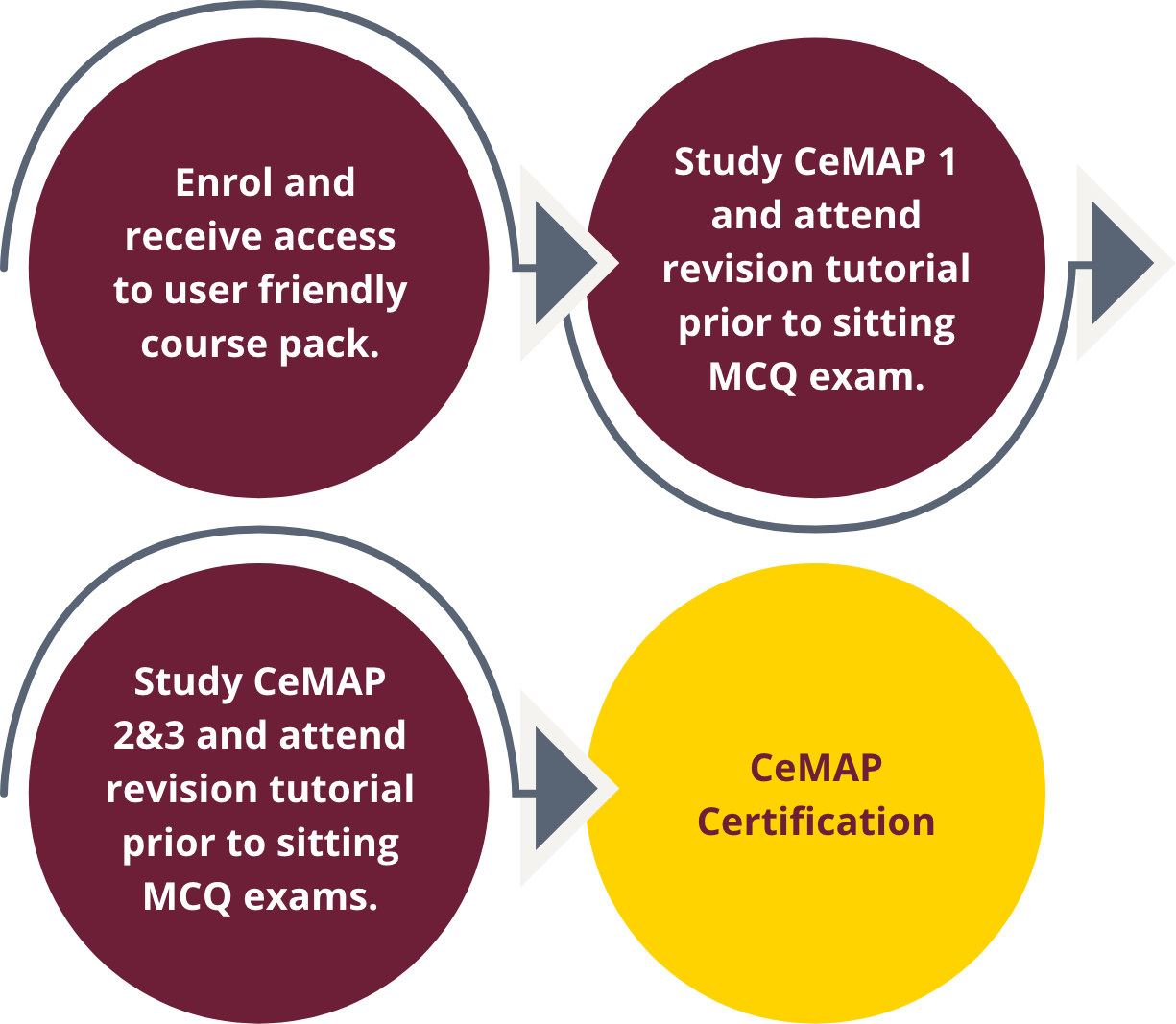

Typical Student Journey

Upon completion, you are able to use the ‘CeMAP’ designation after your name. Typically, self-study students achieve CeMAP status within 3-4 months.

Customer Reviews

We use Coursecheck to collect feedback from everyone we train, so you can see for yourself what customers say about us.

Peter N | 11 April 2025

I really enjoyed the course. Dave the trainer was excellent. The course fully prepared me for the exams which I passed 1st time and definitely wouldn’t have if I hadn’t completed this course 1st. I would definitely recommend.

Dilruba a | 09 April 2025

My overall experience was so good at Simply Academy .Terry is amazing lecturer , I thought it would be a tough journey for me, but he helped me and inspired me a lot , He is the reason why I feel so cinfident now, I an rereally greatful to him and to Simply academy 🫶

Dino D | 09 April 2025

Terry was amazing. Made the whole experience really enjoyable and interesting. Very good teacher.

Book a Course

Course Bundle Deal

Get 10% off when you book full CeMAP use code CEMAP10%