CeMAP Webinar

Study Option: Virtual Classroom

CeMAP Qualification Training Courses.

Welcome to Simply Academy’s CeMAP webinars. If you’re looking to embark on a rewarding career in the finance industry, you’ve come to the right place. Our webinars offer a convenient and interactive way to obtain the highly regarded CeMAP qualification from the comfort of your own home or office.

CeMAP, which stands for Certificate in Mortgage Advice and Practice, is a vital certification for anyone interested in becoming a mortgage adviser or working in the mortgage industry. With our live tutorials, you’ll have the opportunity to learn from industry experts who will guide you through the intricacies of mortgage advice, regulations, and market trends.

Course Fee:

CeMAP 1: £495+vat

CeMAP 2&3: £495+vat

Tip: enrol on both events at the same time to receive 10% off.

Duration:

10 days

(5 days per course, consisting of 10 tutorials each lasting 3 hours)

LIBF Registration Fees:

£223 (per module)

*Price includes exam, membership & learning material.

Tip: ask your course adviser to process on your behalf.

Entry Requirements:

There are no entry requirements for this qualification.

Awarding Body

Remote Delivery

Quality Assured Tuition

User-friendly training materials

Course Structure

The CeMAP webinar course is designed to provide comprehensive training in mortgage advice and help participants prepare for the CeMAP qualification.

Over each 5-day course, attendees can expect to engage in 10 CeMAP lectures, each lasting approximately 3 hours. The course will cover a wide range of topics, including mortgage regulation and different types of mortgages, affordability assessments and the application process.

Participants will have the opportunity to learn from experienced instructors who will guide them through real-world scenarios and case studies, offering practical insights and tips. The webinars will incorporate interactive elements such as quizzes, discussions, and Q&A sessions, allowing participants to clarify any doubts or seek further information. By the end of the course, attendees can expect to have a solid understanding of the CeMAP syllabus, be well prepared for the examination, and feel confident in their ability to provide professional mortgage advice.

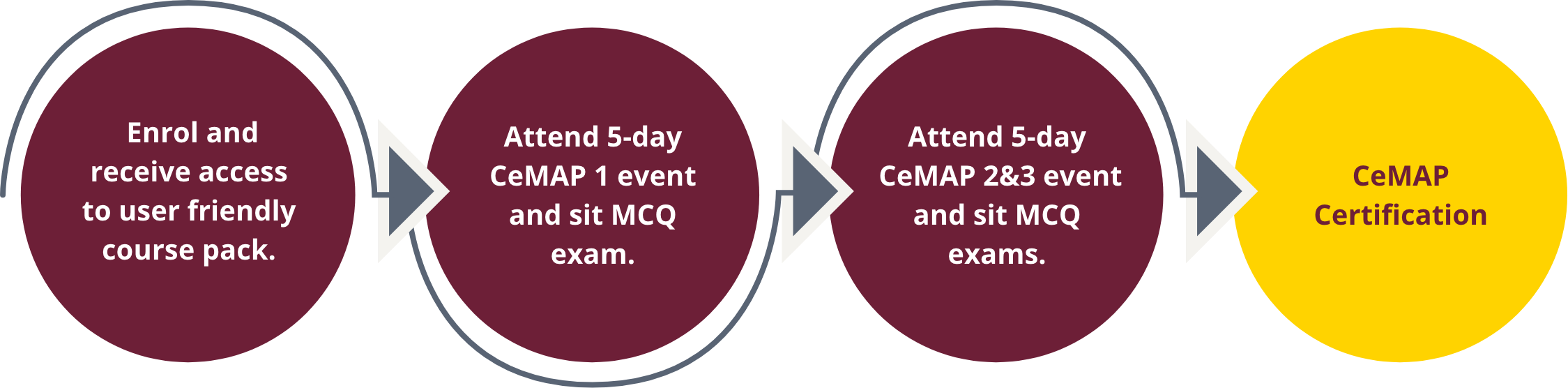

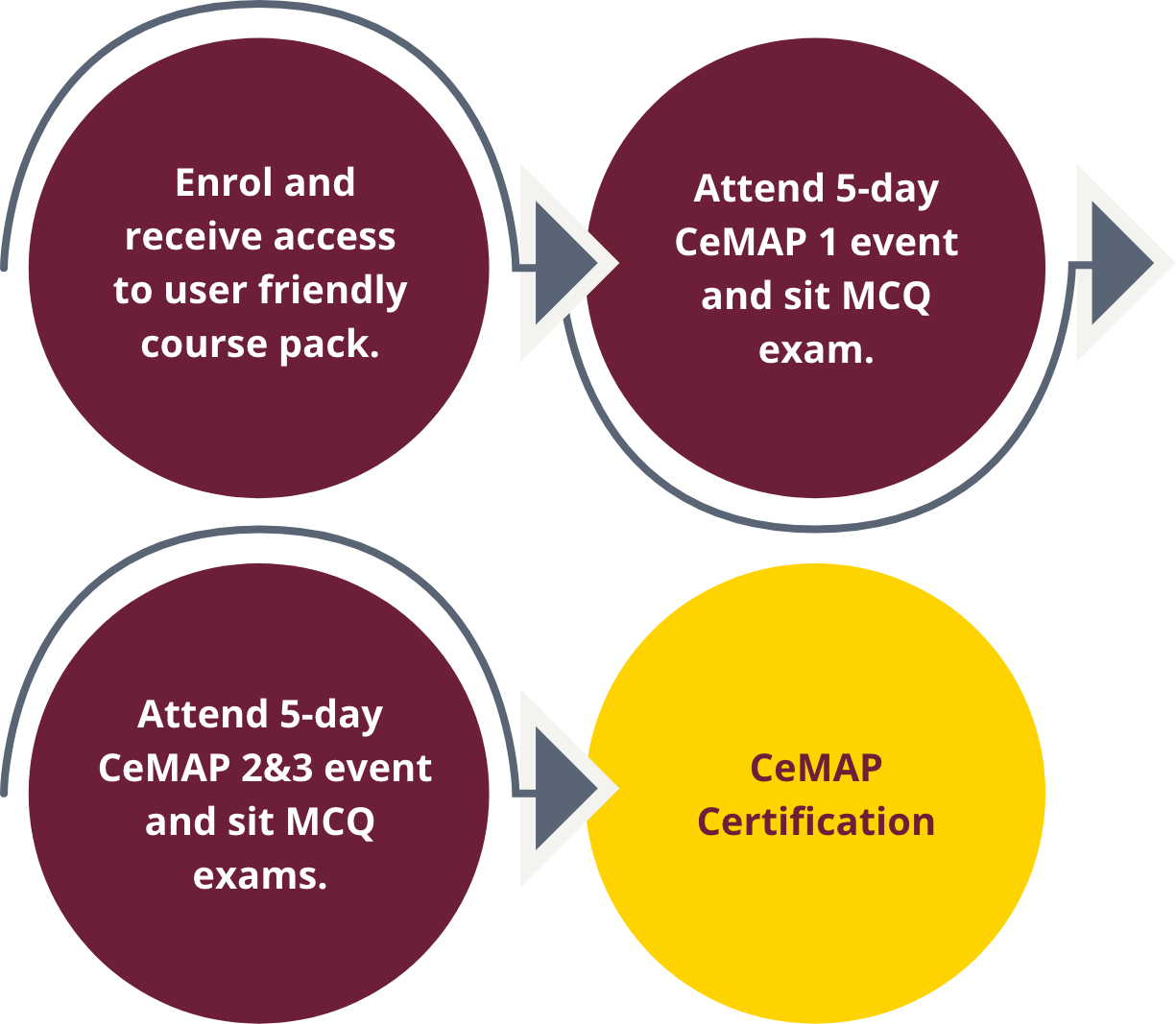

Typical Student Journey

Upon completion, you are able to use the ‘CeMAP’ designation after your name. Typically, classroom-based students achieve CeMAP status within 1-2 months.

Customer Reviews

We use Coursecheck to collect feedback from everyone we train, so you can see for yourself what customers say about us.

Peter N | 11 April 2025

I really enjoyed the course. Dave the trainer was excellent. The course fully prepared me for the exams which I passed 1st time and definitely wouldn’t have if I hadn’t completed this course 1st. I would definitely recommend.

Dilruba a | 09 April 2025

My overall experience was so good at Simply Academy .Terry is amazing lecturer , I thought it would be a tough journey for me, but he helped me and inspired me a lot , He is the reason why I feel so cinfident now, I an rereally greatful to him and to Simply academy 🫶

Dino D | 09 April 2025

Terry was amazing. Made the whole experience really enjoyable and interesting. Very good teacher.

Book a Course

Course Bundle Deal

Get 10% off when you book full CeMAP use code CEMAP10%