DipFA Online Webinar Training

Virtual Classroom

DipFA Qualification & Training Course.

Greetings and welcome to the DipFA webinars at Simply Academy. If you’re eager to pursue a fulfilling career in the finance sector, you’ve arrived at the perfect destination. Our webinars provide a flexible and engaging means to attain the prestigious DipFA qualification without leaving the convenience of your home or workplace.

DipFA, short for the Diploma for Financial Advisers, is an essential accreditation for individuals keen on pursuing a career as a financial adviser or entering the financial services sector. Through interactive live sessions, you’ll gain access to invaluable knowledge and insights shared by industry experts who will walk you through the syllabus step by step.

Course Fee:

Module 1 – FSRE: £500+vat

Module 2 – Taxation: £250+vat

Module 3 – Investment: £375+vat

Module 4 – Protection: £250+vat

Module 5 – Retirement Planning: £375+vat

Module 6 – Coursework: £175+vat

Tip: enrol on all modules at the same time to receive 10% off.

Duration:

14 days tuition (Modules 1 to 5) + eLearning Module 6

LIBF Registration Fees:

Module 1 – £320

Modules 2 to 5 – £220 (each)

Module 6 – £180

*Price includes exam registration + student membership.

Tip: Save time and request our course advisors process on your behalf.

Entry Requirements:

There are no entry requirements for this qualification.

Awarding Body

Remote Delivery

Quality Assured Tuition

User-friendly training materials

Course Structure

The DipFA webinar program has been crafted to offer extensive instruction in financial advisory skills, equipping learners for success in achieving the DipFA certification.

Throughout the duration of the programme, participants can anticipate active involvement in real-time seminars, each with an approximate duration of 3 hours. The curriculum will encompass an array of subjects, covering financial regulation, taxation, investments, protection, and retirement planning.

Attendees will be able to gain knowledge from seasoned educators who will lead them through practical scenarios and case studies, providing valuable insights and recommendations. The webinars will feature interactive components like quizzes, group discussions and Q&A sessions, enabling participants to resolve uncertainties and gather additional information. Upon completing the course, students can anticipate a strong grasp of the DipFA curriculum, thorough readiness for exams, and a heightened self-assurance in delivering expert financial advice.

Module 1 – FSRE: 8 tutorials (3 hours each) over 4 days

Module 2 – Taxation: 4 tutorials (3 hours each) over 2 days

Module 3 – Investment: 6 tutorials (3 hours each) over 3 days

Module 4 – Protection: 4 tutorials (3 hours each) over 2 days

Module 5 – Retirement Planning: 6 tutorials (3 hours each) over 3 days

Module 6: Coursework

eLearning programme designed to offer support & advice when drafting your assignment.

*You may choose to study Modules in any order.

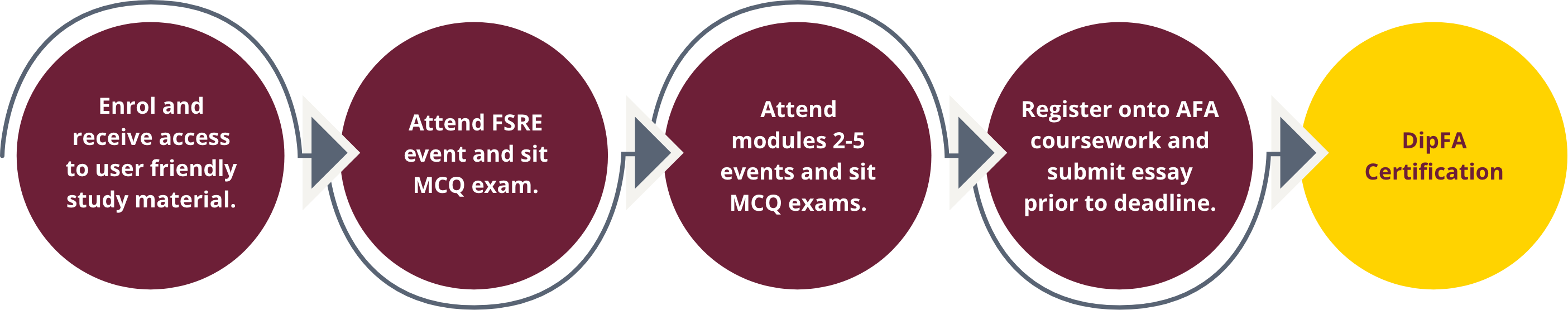

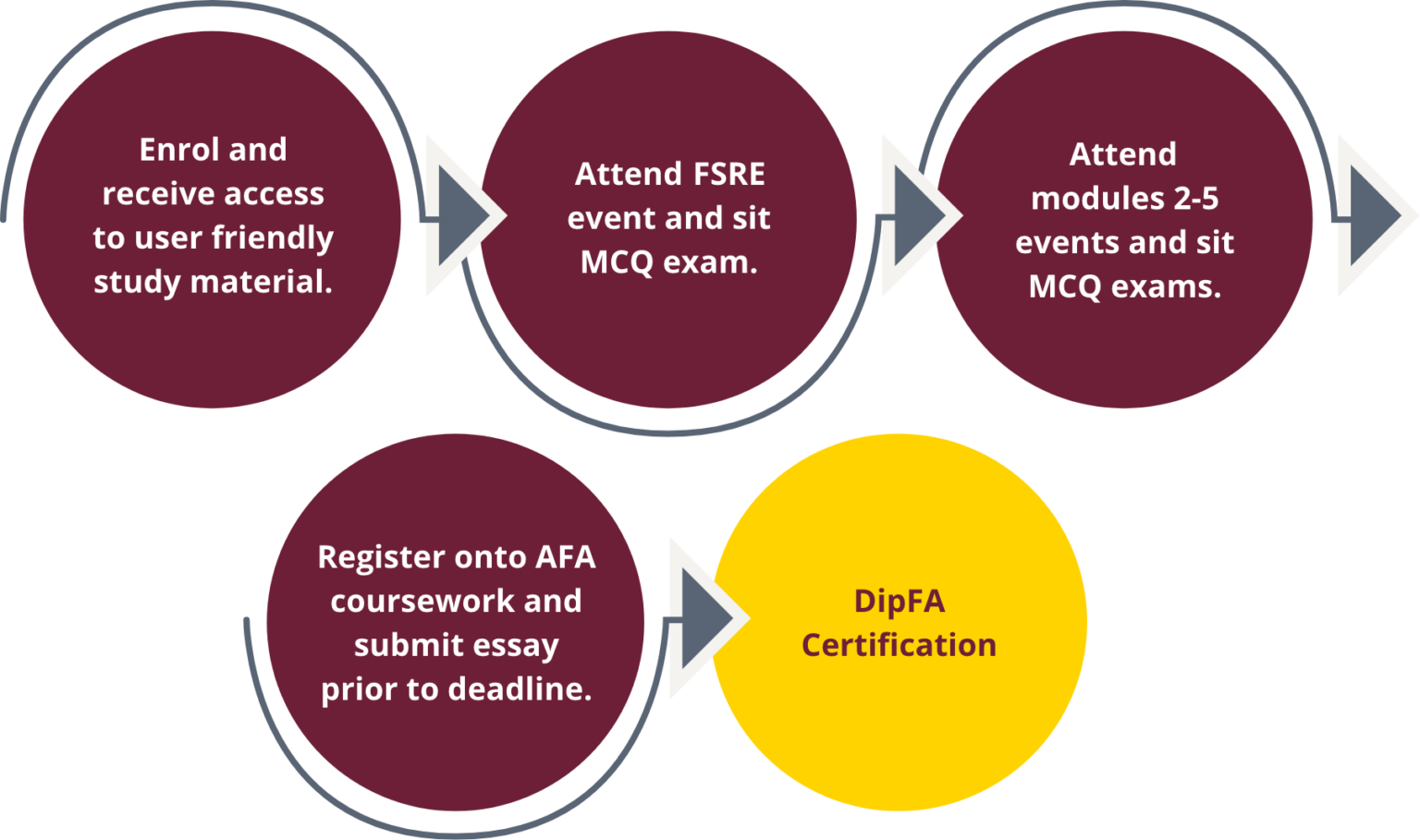

Typical Student Journey

Upon completion, you are able to use the “DipFA” designation after your name. Typically, students achieve Diploma for Financial Advisers status with 6 months of part time study.

Customer Reviews

We use Coursecheck to collect feedback from everyone we train, so you can see for yourself what customers say about us.

Peter N | 11 April 2025

I really enjoyed the course. Dave the trainer was excellent. The course fully prepared me for the exams which I passed 1st time and definitely wouldn’t have if I hadn’t completed this course 1st. I would definitely recommend.

Dilruba a | 09 April 2025

My overall experience was so good at Simply Academy .Terry is amazing lecturer , I thought it would be a tough journey for me, but he helped me and inspired me a lot , He is the reason why I feel so cinfident now, I an rereally greatful to him and to Simply academy 🫶

Dino D | 09 April 2025

Terry was amazing. Made the whole experience really enjoyable and interesting. Very good teacher.

Book a Course

Course Bundle Deal

Get 10% off when you book full DipFA use code DIPFA10%